Top 10 Weakest Currencies in Africa 2025

By ICON TEAM | Published on Oct 04, 2025

In 2025, Africa's economy is a mix of strength and weakness, with currency values showing deeper fundamental problems in the face of global uncertainty. As of September 2025, Forbes currency data shows that various African countries are dealing with local currencies that have lost value compared to the US dollar. This is due to things like ongoing trade deficits, unstable commodity prices, unstable politics, and low foreign reserves. These problems make inflation worse, lower people's buying power, and slow down long-term growth. This article looks at the ten worst currencies, ordered by their exchange rates to the US dollar. It talks about the economic situations, fundamental reasons, and bigger effects of each one. Keep in mind that exchange rates might change. For example, the Nigerian naira has been stronger in the last few months.

List Of Top 10 Weakest Currencies in Africa 2025:

1. São Tomé & Príncipe Dobra (STN) - 22,282 STN per USD:

São Tomé & Príncipe, a small island republic in the Gulf of Guinea with about 220,000 people, has the weakest currency in Africa. The dobra's huge drop in value shows how hard it is for small island developing states (SIDS) to deal with their economies, which are even more fragile since they are so far away from other countries. Cocoa exports, tourism, and foreign aid are very important to the country's economy, but it isn't very diverse, thus it is vulnerable to changes in global commodity prices and climate change.

The dobra is weak for a number of reasons, including structural problems like poor infrastructure, a huge public debt (over 70% of GDP), and a persistent current account deficit caused by relying on imports for basic needs like food and gasoline. Unreliable electricity, made worse by old power plants, has slowed down industrial expansion and kept investors away. This means that real GDP growth is only expected to be 2.9% in 2025. Political stability has gotten better since the 2021 elections, but reserves are still being drained by election-year expenditures and exogenous shocks like growing global oil costs.

The effects are clear: rising import costs have caused inflation to rise to 8–10%, which hurts low-income families the most and makes it harder for them to get essential items. The government is pushing for changes including restructuring state-owned businesses and investing in renewable energy to boost exports. The IMF is helping with these changes. But the dobra's problems may not go away unless they diversify into fisheries or eco-tourism. This is a sign of how hard it is for small economies to survive in a world where the dollar is king.

2. Sierra Leone Leone (SLL) - 20,970 SLL per USD:

The leone in Sierra Leone is Africa's second-weakest currency. It shows how hard the country is having to work to get back on its feet after the Ebola outbreak and the civil war. This West African country has a lot of minerals, such diamonds and iron ore. Its GDP growth has been about 4-5% in 2025, but the currency is under strain because of its small export base and external shocks.

The leone is losing value because Sierra Leone's economy depends heavily on unstable commodity exports, which make up 60% of GDP. The country also has irregular rainfall and rising temperatures that endanger agriculture. Sierra Leone is one of the 15 most climate-vulnerable economies. Foreign direct investment (FDI) is limited because of problems with corruption and governance, and the macroeconomic climate is tough because of huge public debt (over 80% of GDP), which drains reserves. Floods in early 2025 forced thousands of people to leave their homes, which caused food imports to rise and inflation to reach 25%. One effect is that people can't buy as much, which makes imported necessities like rice too expensive, which leads to social discontent. The World Bank suggests climate-resilient farming and anti-corruption campaigns. The government has issued bonds to maintain reserves, but long-term changes are needed to stop further declines.

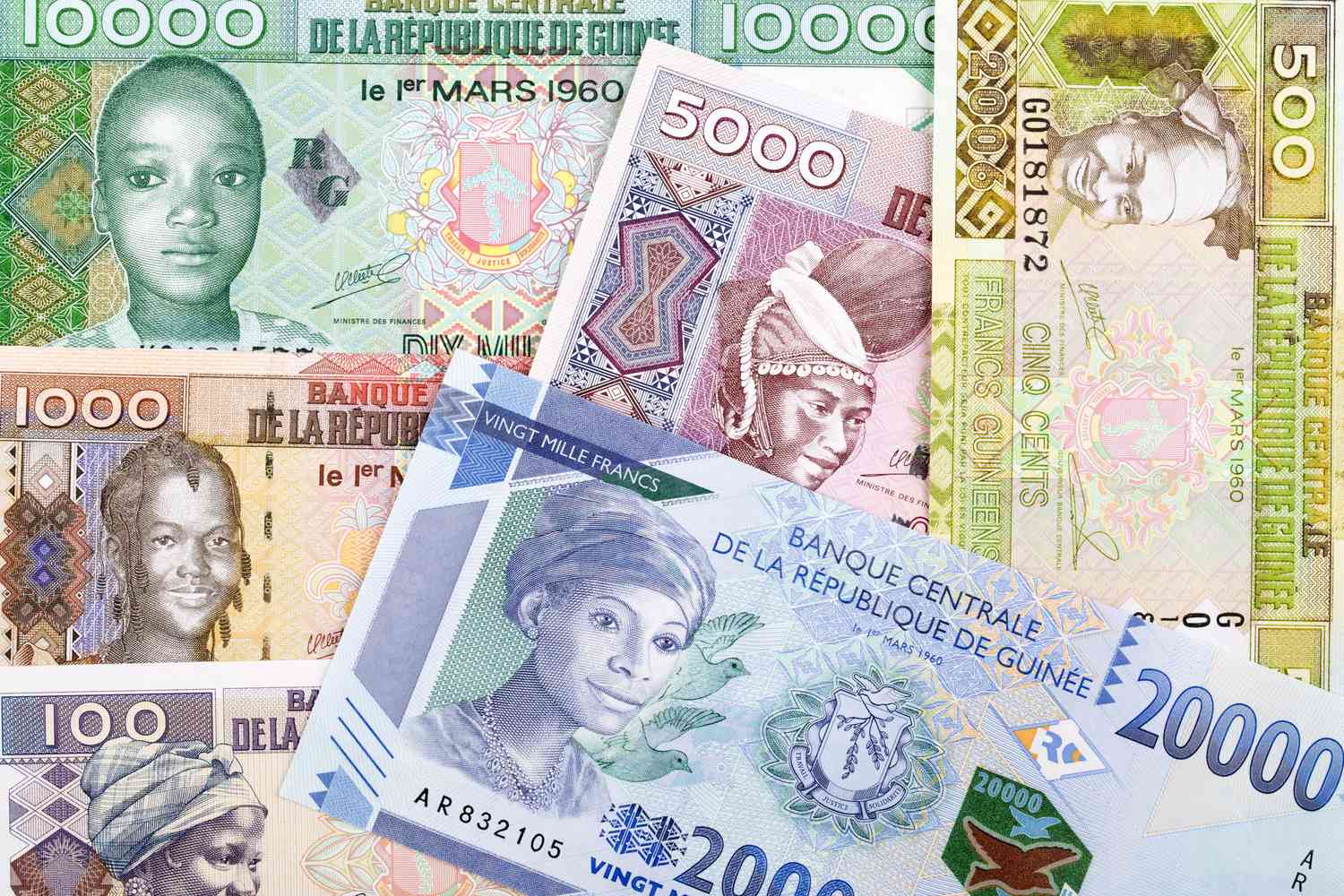

3. Guinea Guinean Franc (GNF) - 8,680 GNF per USD:

The franc in Guinea shows how having a lot of resources can be both good and bad in a country with a lot of political problems. The economy grew by 5.5% in 2025, thanks in part to the country's enormous bauxite reserves. However, the currency is still weak because not everyone profits equally from mining booms.

The franc is weak because it relies too much on minerals (90% of exports), which makes it vulnerable to changes in world prices. The country's infrastructure is also poor, and small and medium-sized businesses have trouble getting loans, which makes it hard to diversify. A coup in 2021 left the country unstable, which scared investors and raised the cost of logistics. S&P rates the economy's sensitivity to terms-of-trade shocks as "B+" because the GDP per capita is less than $1,500. The reduction to gasoline subsidies caused inflation to rise to 12% in the middle of the year.

This has made it more expensive to pay off debt and made inequality worse, with rural areas—where 70% of the workforce lives—being hit most by rising food prices. The junta's desire for Chinese partnerships to help with mining and infrastructure is a good start, but the franc won't recover unless the government is open.

4. Uganda: Ugandan Shilling (UGX) - 3,503 UGX per USD:

The Ugandan shilling's position shows that the economy is quite steady, with GDP growth of 6% in 2025 because to preparations in the oil sector and agriculture. But because of constant demands from importers and trade imbalances, it stays one of the weakest.

Changes happen because there are seasonal needs for hard currency to import gasoline and machinery that are higher than coffee and gold exports. Interbank dollar hoarding and a growing current account deficit (7% of GDP) put pressure on reserves, but central bank actions have kept things mostly stable, with a 4% increase year-on-year by mid-2025. Tensions between countries in the area and a strong currency around the world make things less stable.

One effect is that inflation is lower at 5%, but rising import costs are hard on manufacturers. Uganda has $5.7 billion in reserves and tax changes that could help the shilling in the long term. Oil exports could also help the shilling.

5. Burundi: Burundian Franc (BIF) - 2,968 BIF per USD:

The scars of political unrest and isolation are visible in Burundi's franc. The East African country is landlocked and has a GDP growth rate of 3%. It is chronically underdeveloped, with 70% of its people living in poverty.

Low export revenues from coffee and tea, the end of an IMF program in 2024 that raised budget deficits to 5% of GDP, and FX rationing since reserves are less than three months' worth of imports are all reasons for depreciation. After the 2015 crisis, political persecution makes it harder for help and foreign direct investment to come in. Inflation has dropped to 12.6%, but it is still high because of food shortages.

This lowers the quality of life since remittances, which are important sources of income, are losing value. The EAC and changes to farming could help the economy get back on track, but changes to how the government works are necessary.

6. Democratic Republic of Congo (DRC): Congolese Franc (CDF) - 2,811 CDF per USD:

The DRC has a lot of minerals, such cobalt and copper, but its currency isn't very strong, and the country is one of Africa's most unstable. Mining added 8% to GDP in 2025, but the benefits are hurt by fighting in the east.

Historically, the franc lost value because of dollarization, with up to 70% of transactions being in USD. It fell 30% before 2025, although tight measures helped it a little in September. A lot of infrastructure needs to be imported, there are fiscal deficits (3% of GDP), and M23 rebels are causing problems, which makes things worse.

There is a potential of hyperinflation, which would displace millions of people and raise food prices. Peace agreements and efforts to get rid of the dollar are both important for stability.

7. Tanzania: Tanzanian Shilling (TZS) - 2,465 TZS per USD:

The Tanzanian shilling was the worst performing currency in the world in early 2025, falling 8.9%. This is because the country's economy is growing too quickly because of imports. Infrastructure booms raised GDP to 6.5%, albeit at the cost of the currency.

Imports for projects and consumer items are growing faster than tourist and gold exports, and governmental debt is 40% of GDP, which makes things further harder. Historically, election fears have made it weaker, but reserves reached $6 billion in the middle of the year.

4% inflation is okay, but paying off debt is hard. Export diversification and BoT actions are meant to keep it stable.

8. Malawi: Malawian Kwacha (MWK) - 1,737 MWK per USD:

The kwacha in Malawi is having a hard time because of problems in the agricultural sector and the economy. The economy that depended on tobacco rose by 3.5%, but droughts destroyed the crops.

Low reserves, spending on the election (which put the deficit at 8.7% of GDP), and the aftermath of Cyclone Freddy are all draining buffers. Overvaluation hurts exports. Three million people are hungrier because food imports are 25% more expensive.

Aid money and changes to the foreign exchange market give us optimism, but adapting to climate change is really important.

9. Nigeria: Nigerian Naira (NGN) - 1,490 NGN per USD (September; strengthened to ~1,455 by October):

Nigeria's naira, which is a measure of Africa's largest economy, was under pressure from oil price swings in 2025 but bounced back at the end of the year.

Misaligned rates affecting budgets caused weakness from FX speculation, dependency on imports, and 20% disinflation (from 24.5% to 17%). Reserves reached $42 billion, which stopped speculation.

There was 32% inflation in the middle of the year, but reforms like getting rid of subsidies helped stabilize it. Oil at $80 a barrel helps the outlook.

10. Rwanda: Rwandan Franc (RWF) - 1,448 RWF per USD:

Rwanda's franc is down 19% in 2025, which goes against its "Africa rising" story. There is a 7% growth in tourism and services, although trade imbalances still exist.

It is under strain since it has to pay more for construction materials and its deficit is growing (12% of GDP). Manufacturing is also not producing enough. The strength of EAC counterparts makes relative weakness stronger.

Inflation is at 5%, but demand for foreign currency is putting a strain on reserves. Export hubs and pushes for the digital economy could change things.

Comments 0